Many Americans dream of retiring early, getting to take life one day at a time at their own pace, and just relax after years and years of working. That’s the dream, right? Yet one main barrier stands in between Americans and actually retiring early like many of them want to.

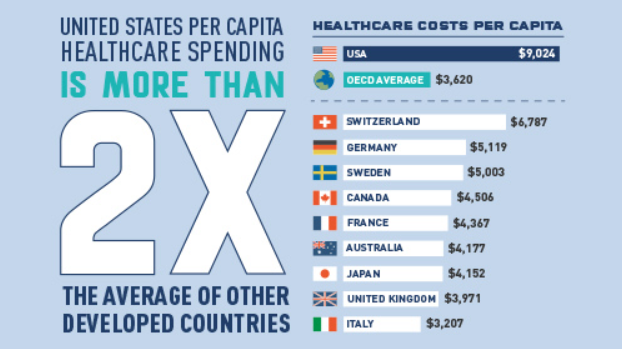

According to a TD Ameritrade survey, health costs are the primary reason why many Americans don’t move forward with early retirement. Additionally, U.S. adults who are 45+ and have over $250,000 in investable assets, a stunning 57% of them say that health costs are the reason why they have not left work for early retirement.

If you’re in the same boat as thousands of other Americans where you want to retire early, but you fear medical expenses may hinder you, there is some good news! There are some tips to keep in mind that will not only help your expenses during retirement but also during the remainder of your working years as well.

1. Lower your healthcare spending

Having the wrong insurance plan that doesn’t suit your needs or not understanding how your health plan works are two sure-fire ways to overspend on your medical costs. While you might be more inclined to gravitate towards the lowest premiums available to you, that could actually backfire and have you paying more out-of-pocket with little coverage than you might think.

The best idea is to really shop around and take a deep look at different healthcare plans to see which one is right for you. Additionally, if you happen to choose a plan that is paid in higher premiums, the plan will compensate for helping you to save on deductibles and copays. Essentially, just make sure you know the drill about your own healthcare plan, as a survey showed that 48% of Americans actually don’t!

2. Understanding the available plans

According to Cedar Valley Business Monthly, “Staying in network, obtaining referrals, or getting pre-authorized for certain procedures or diagnostic exams could lower your out-of-pocket costs tremendously,” so it’s important to ask when you’re not sure about what service you’re entitled to under your plan.

You also have the choice for a Medicare plan or completely ridding that idea and going with an Advantage plan; no matter which one you choose, it’s important to understand what covers what so you aren’t paying more out-of-pocket than you need to.

3. Planning ahead for retirement

There are some medical expenses that are just outright inevitable and unavoidable. However, there are ways to make sure your savings are in proper order and that you have the money to cover any medical expenses you may encounter during your retirement. One great option is opening a health savings account (HSA), if eligible.

The Cedar Valley Business Monthly says, “Not only do you get to deduct your HSA contributions on your taxes up front, but the money that sits in your account gets to grow tax-free as long as you use it for qualifying medical expenses.” This means should you qualify for an HSA, it could seriously help with your medical expenses in the long run.

4. Utilize your 401(k)

While your IRA and 401(k) aren’t necessarily for healthcare costs, making sure money is tucked away in there long before you even think about retiring will ensure that you’ll be covered for any future medical costs.

By following any or all of these tips, you can be sure that all healthcare expenses or any additional future medical costs will be covered and available to you. So, don’t stop thinking about early retirement yet! If it works for you, there’s no better time than now.

Be sure to SHARE this article if you’re planning an early retirement!