Insurance is important, but for celebrities insuring their body parts is crucial, considering they can make or break their careers. Many have term, life and other types of insurance on their legs, butts and even their breasts. Some even have insurance on odd body parts such as their tongue. Can you imagine the type of insurance premium on those types of items? You’ll find out when you read below.

1. Jennifer Lopez

Jennifer Lopez, the famous pop singer, and actress, actually took out a nice big term insurance policy on her famous booty. How much? $300 million dollars! What could possibly go wrong? It is quite possible this premium covers excess cellulite, scratches, and any other medical and physical blemishes on her buttocks that could occur during the course of her career. And since she has dance moves, if she were to tear her gluteal muscles during a dance performance, she would be covered under this policy.

2. Mariah Carey

Although you would think pop singer Mariah Carey would secure her voice with life insurance, she actually targeted her legs. In 2006, Carey insured her legs for a whopping $1 billion dollars! Can you imagine what her monthly payments are? This is the highest policy by any celebrity known to mankind. Even though she is basically retired, what would she still need it for? It is possible it’s for self-security and pride. I assume if she were to get in a car accident or any other type of accident, her insurance company will pay out the full premium if there were any scratches or bruises on her legs. It is unknown whether a serious knee injury such as an ACL tear would be covered. Like J Lo’s policy, excess cellulite may also be covered under this policy.

3. Holly Madison

As Hugh Hefner’s former girlfriend and popular reality television superstar, it is easy to see why he picked her. Her breasts were actually insured with a $1 million insurance premium. This was around the time she joined and created her Las Vegas show called Peepshow. This type of body part insurance policy could cover a wide range of items, such as the silicone implants, plastic surgery mishaps, and any other medical and physical abnormalities that may occur during her successful career.

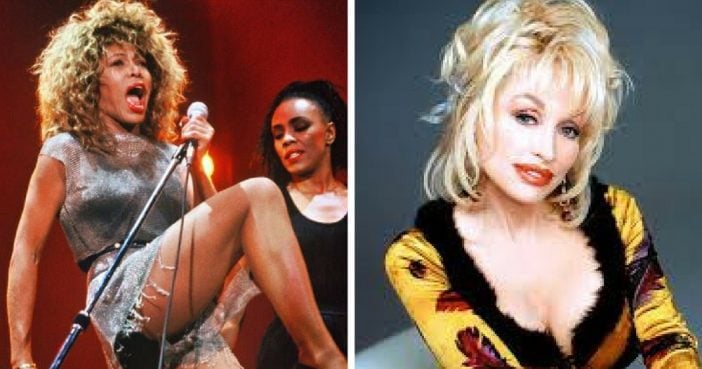

4. Dolly Parton

In the 1970’s, Parton took out insurance on her breasts for $600,000, which was an extremely high premium back in the day. Today, you’d think she would be taking out life insurance, but this isn’t the case. Instead, she recently took another insurance policy on her chest for $3.8 Million. This is a very interesting policy considering how old she is, and she really isn’t active both musically and on the big screen. Anyway, if one of her balloons were to deflate due to some medical condition or disease, Dolly would get a huge payout.

5. Miley Cyrus

It might not be a surprise that pop star Miley Cyrus insured her tongue for $1 million since all she does is stick it out all day. I mean, someone might just have scissors in hand and cut her tongue off. So maybe, in perspective, it really is worth that much. “Miley’s totally aware of how her tongue is getting more headlines than she is, and getting it insured is just part of her trademarked image,” said an unnamed source. It is unknown what the deductible would be on this kind of policy, but if she were to burn her tongue after drinking a hot cup of coffee, would it be covered by this premium?

6. Taylor Swift

Pop Singer Taylor Swift may have made her name off the power of her voice, but it doesn’t hurt that the girl knows how to strut a stage. And now she’s safeguarding the most crucial asset to this. Yes, Taylor has insured her legs for a whopping $40 million dollars. Her legs are absolutely stunning and they deserve to be insured. All medical issues that affect the appearance of her legs such as bruises, permanent skin damage, torn tendons, fractured bones and anything else that would leave scars would be covered.

7. Rihanna

The 19-year-old Barbados born pop singer was named 2007 Venus Breeze’s “Celebrity Legs Of A Goddess” by Gillette Razors at NYC’s Metropolitan Pavilion. Gillette helped insured Rihanna’s legs with a $1 million dollar insurance policy! When you look at them, you can certainly see why. As a performer, many things can go wrong on stage. A simple fall or misstep can lead to a torn ACL, MCL, or Achilles tendon which would be covered by her large insurance policy, minus the deductible. I wonder what her monthly payments are!

8. Jennifer Love Hewitt

Actress Jennifer Love Hewitt knows what her best assets are and she is willing to protect them. The actress admitted to a magazine that she would consider getting her size 36C breasts insured for somewhere around the $5 million range. “I need, like, an insurance invitation. If somebody was like Hey, you know what? We would like to insure your boobs for $2.5 million dollars, I’d be like, Do it. Love it! Why not?” Since her balloons appear to be real, not much could go wrong. If she were to get injured in a car accident or any other type of accident, her insurance policy would cover all medical costs.

9. Heidi Klum

Here we have miss Heidi Klum, one of the biggest Victoria’s Secret supermodels of our time, with a massive insurance policy on her legs. Supposedly the legs are worth over $2 million! Can you imagine the monthly payments and deductible on that amount? Many things would be covered here, including runway accidents. We all know high heels are hard to walk in. If she were to need a medical visit and surgery due to falling on the catwalk and tearing a ligament in her knees or ankles, this premium would cover it. I would assume issues arising from laser hair removal and any other cosmetic surgeries would be covered as well.

10. Madonna

This material girl pop star singer felt the need to pay an expensive insurance premium for her breasts worth $2 million. Maybe those cone bras that she wears during her concerts are more dangerous than they look. Although she is not known for the size of her balloons, they are one of her best assets. Size isn’t everything. It is unknown whether she had plastic surgery done to enhance the size of her breasts. If so, complications during surgery will definitely be covered with her insurance policy.